There are three main competing models in the vacation rental market today:

the Traveler Oriented Model (PLW see previous blog post for details on this acronym): The Property Owner (PO) pays for listing, the Traveler pays just the net price with no commissions added.

the Owner Oriented Model (PAYG): The Property Owner lists for free and only pays a small commission or none when she gets a booking, the Traveler is charged 10 to 30% commission at the moment of booking.

the Owner+Traveler Oriented Model (or PayPerLead PPL): Neither the PO, nor the Traveler are charged all costs falling on the PM listing in bulk

The online vacation rental world has been quietly dominated by the PLW model ever since it's origin for well over a decade. It's not like the PAYG model did not exist, on the contrary, it was live and well since its origins when some locally based Property Management Companies (PMs) with a live website were using something similar to what is the PAYG model today. Most PMs were coming from the Real Estate Agents experience (if they weren't one themselves) and tended to charge both PO and Traveler. Come the mid 90's though, some PMs started charging only or mostly the traveler a commission which then also included fees on services such as cleaning/check-in etc (ie Roman Reference since 1997). Within the first decade of the new millennium a few pure websites using the PAYG model started pure online operations, one of these, of course, is Cities Reference since 2006. Enough of self quotations, just to hint that we know where we are coming from and what we're talking about here. Nevertheless, during the first decade of the new millennium online services were still broadly intended as owners' direct services with PLW models (today known under the oligopolistic brands of Homeaway (HA) and Tripadvisor/Flipkey (TA/FK) as opposed to local PMs using various forms of PAYG models which were less competitive in cost to travelers, but more competitive in service. The vacation rental market couldn't be called mature, but it had reached some sort of a balance.

Disruption came in 2008 when FK (now a Tripadvisor company) started a then totally new business model, the PayPerLead (PPL above), targeted straight to PMs that couldn't afford or wouldn't go for PLW listing. It was quite an innovation for the market and the first attempt to aggregate a very chaotic market offering a brand new channel for PMs where they could compete with their own brand.

At the turn of the second decade of the second millennium Airbnb (Air) got its venture's hundreds of millions (July 2011) and the PAYG model as a whole got a -very conservative since it's forgetting Wimdu and its peers altogether- cumulated 530$ millions up to 2013 and took the lead... that is, on the press and consequently on the general perception. Was that real disruption? Think again.

Number of properties: we all know how numbers can be delusional, if that is true in general, more so in vacation rentals. On our own experience the majority of properties have 1euro value per year against a top 10% of properties that are worth 500euro a year, still, this is a measure that must be taken into consideration. Airbnb declares 300,000 properties (other sources say 500,000, notably Ken Yeung in an article on thenextweb that doesn't reveal its sources), against Homeaway's 773,000 and Flipkey's 240,000.

Ever more interesting measure since we are calling Homeaway model Traveler Oriented! On the other hand these figures can't be taken without doubts, for example, the meta title of Homeaway.com reads '65,000 + vacation rentals worldwide.' Interesting... true they own tens of different websites and VRBO reads 'over 75,000 listings', but it's a safe guess that many properties overlap, that numbers declared will likely be floated etc. Anyway it is already something to know that Homeaway claims to have more properties than Airbnb and no-one, that I know of, has yet blowed the whistle. HA takes 1.

Number of destinations: 171 countries in Homeaway against 192 countries and 33,000 destinations in Airbnb and 11,000 destinations on FK. HA declines to share the number of destinations it covers, but we can play the same game of above and consider that Airbnb declares more destinations and no-one seems to be complaining about it, so far. 1 all.

Traffic: this is also an interesting exercise and we can use Alexa as a metric. Starting with the .com Air is ahead being 1,923 against 2,901 of HA (but it must be stressed that VRBO, a HA property, ranks 2,435, so better than its owner's company .com, still somewhat short of AIR, but that gives the general measure of how there cannot be competition among the two), FK is down at a mere 5,996, not so if you consider its mother company TA at 204 (!) although we don't think that could count here; co.uk HA is ahead being 12,129 against 17,866 (and it ownes Ownersdirect.co.uk wich is 16,537); .fr Air is 15,122 while HA with Abritel is 12,122 and with Homelidays is 13,012 so HA is ahead; .de Air is 18,609 HA with Fewo-Direct is 9,308, so HA ahead again; .it Air 18,165 and HA 41,698 so this time HA is big time in delay, AIR has a flair in Italy for some reasons; .es Air 16,809 against 53,364, so Air is leading again, but HA owns Toprural which ranks 24,114, so the spread is lower than you think.

Leaving aside FK which can't really compete here and looking deeper into the numbers we notice a number of interesting things: 1. that growth rate in traffic for HA is higher than for Air 2. that the search share of traffic is higher on HA(18.5%) then on Air (11.7%), does it spell for better SEO? 3. that traffic, although mainly US in both websites, is then distributed on travel buyer's countries (Spain, Italy, Canada, France - 16% of client base source Cities Reference) in HA as opposed to AIR that has secondary traffic distributed in more typically SEO labor countries (India, Mexico, Brazil, Thailand short of 2% of client base source Cities Reference) 4. On the other hand Air engages its users a lot more judging by bounce rate and pages per user, but this doesn't spell for higher conversions attending Compete.com. HA takes the lead again.

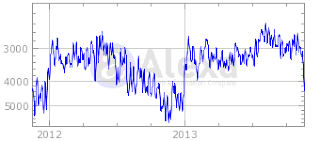

The Stock: If we give a look at what the financial guys are saying about this I'd like to take into consideration what Estimize says since starting last June they're publicly attempting to 'estimize' private companies. Here is what Estimize CEO/co-founder Mr. Drogen thinks about the matter we're discussing on this post. He runs an estimate on the base of what Airbnb states on its infographics and concludes that Airbnb is set to outrun HA. Is he right? I'd be very cautious about this, do read at the bottom of the above post how user AirBnB Whistleblower de-codifies numbers claimed on the infographic, de-codifying Airbnb numbers you'll find yourself listening to a different story from the one you're watching... HA 3, AIR 1. FK doesn't qualify here.

Mistifications: There seem to be little doubt on the mystifications of airbnb infographics as I was hinting above, this said on the contrary HA measures are relatively more reliable than Air's, there is more ahead on this. This is not because HA has better ethics, ethics has never been on HA menu, it's just because AIR has managed to still keep away from going public and avoid the scrutiny that follows IPOs. If you look carefully at the info-graphics below there is more than meets the eye. One example? "Guests nights booked" is not to be confused with actual nights booked, uh? HA 4, AIR 1.

Our Test: And... we have been testing the two behemoths this Fall! More precisely we posted 3 test properties: 1 in Rome, 1 in Paris and 1 villa in Sicily. The Paris apartment has 36% more visits on Airbnb than HA, but, mind you, no leads whatsoever, while TA has a 30% conversion into leads. FK here wins, it has way more traffic than both the above (~200%) with a 4% of conversion into leads and 3 real bookings made! The Rome apartment has 9% more visits on Airbnb, but, mind you, again no leads, while TA has an 18% conversion of lookers into leads, FK is a lot weaker than both here with about half traffic and 1% conversions and no bookings. The Sicily Villa has 18% more visits on AIR with ~1% of lookers converted into leads while HA has a 4% conversion. FK is extremely low on traffic with a ~1% conversion.

Pay attention, no bookings for the posted properties in the past 90 days neither from HA nor from AIR, but a bunch of leads from HA turned into other conversions in the rest of our inventory while nothing like that is possible in the closed system of Airbnb! FK converted only on the Paris apartment, but it has to be stressed that it wasn't new to the site and had reviews, while the new ones competing shoulder to shoulder didn't really qualify. Still it does work impressively when you get reviews. Look at this factor from the PMs perspective and... more on this ahead.

What do we see here? We see that numbers showed by Airbnb are, once again, dubious ~0% conversions on leads (mind you, it's Questions of travelers, not Bookings, what we're calling conversions here) on almost 1,000 visits compared to the over 20% conversions on the same properties on HA. Really? HA 5, AIR 1, FK1

How are they behaving? In everyday life it's the most common thing, to look at how a person is behaving and draw conclusions. If that still stand some chances of getting it right, does that rule still stand if there are big interests and organizations involved? Mmmm, not really. Looking at it from the outside we see HomeAway struggling. Every day there is a new, almost incomprehensible and very steep fee on their subscriptions page, now HA is even shooting on its own foot by opening to the PAYG model, see more details on Skift, while AirBnb is booming and busting on all medias and creating high expectations. We suspect this may all be a facade. HA seems to be struggling just because it's been a public company for years now and has to keep growing inventory and turn-over to make investors happy, while AirBnb shows hubris just because there are interest behind them ever since they got their venture money that want to turn them into the next internet bubble IPO and will possibly abandon it soon after. There is ground here to doubt that AIR will keep shining for long after going public. FK has been also embracing revenue share. So, this is still a score to AIR though: 5 to 2.

Our Poll or the users' perception: We've been running a poll with our users, travelers, POs and PMs. General perception of travelers is all for AIR, they vote for their graphics (which has been defined as shiny and cool as opposed to boring and depressing for HA), for their social appeal and easiness of use. Most also post their own apartments. But they list as travelers, not professionals, they don't update the calendars, reply only if the request falls in the right dates, or if the user looks cool, they (ouch!) wouldn't even consider listing with Cities Reference when asked (not to our face!), never mind HA that is even asking for money. POs and PMs are divided, we've been surprised finding out that almost 30% of PMs also uses AIR and declares itself satisfied by it. That's definitely a go for AIR again 5 to 3.

We have a winner of our little game: HomeAway! Flipkey comes a good second, AIR from our perspective looks in quagmires.

Really, why do we think that, against all odds, taking the press online and offline (see estimize above), against the general perception, see our poll, against what we thought ourselves just until a couple of years ago, the HomeAway model will win the battle over the vacation rental world dominance? Let's look at it from the perspective of those that actually use these tools, once the shine about the 'new' tool (is it really new? I will soon post a 'Disruptive Innovation or... just Disruptive' article about the elephant in the room of vacation rental) will fade away, they will have to cope with facts, and here is how we see the facts from the different perspectives.

The Traveler perspective: young travelers are charmed by the social feel, the easiness of use, the bright colors of AIR/PAYG websites and claim not to even consider PLW websites. Seasoned travelers on the contrary are matter of fact and realize that PLW and PPL websites won't charge commissions and eventually will give them better deals. Phocuswright claims that vacation rentals are mainly used by families and groups that are more price sensitive, the average 15% overcharge of PAYG websites, once the hipe is over, will make a difference.

The Property Owner perspective: It is true that property owners don't like to pay in advance and in the case of Homeaway prices are getting steeper and ever more complicated by the day, which doesn't help. Still, as we've seen on our testing, PAYG websites will hardly give you a full occupancy unless the apartment you're listing is sold at a net price below its market value. It is important to stress that all the property owners we have interviewed once they pay the flat annual fee to PLW websites just forget about that charge and when they list on PAYG websites they will not write it off the base price creating an extra charge that will be pushed on to the traveler buying on PAYG websites. Get a better grasp on how this maybe a problem for PAYG websites on our previous post 'The ponderability of Prices'

The Property Manager perspective: Most PM marketing departments are understaffed. PMs are historically more focused on operational and sales (meaning acquisitions of new properties). Closed systems on PAYGs websites like Airbnb force them to list each single property thereby using a lot of their precious time for precious little conversions. Until Homeaway will close a blind eye on PMs listings multiple properties at a discount as private owners (that are ranked better on most PLW websites), the possibility of moving leads across their inventory will push more and more PMs towards PLWs as opposed to PAYGs which use closed systems that are at odds with the way most PMs conduct their businesses. Finally, PPL is a fantastic deal for PMs that can afford the little technology required to pass the properties to PPL websites in mass.

I would like to close this with a note on what my really be THE disruptive innovation taking more and more shape now in the vacation rental market. Channel managers, like Rentals United and Kigo, they are a further tool in the hands of PMs to pool together and share properties and bookings. We'll dedicate a post to it soon, but this may really be the future of the market. Keep posted ;)

the Traveler Oriented Model (PLW see previous blog post for details on this acronym): The Property Owner (PO) pays for listing, the Traveler pays just the net price with no commissions added.

the Owner Oriented Model (PAYG): The Property Owner lists for free and only pays a small commission or none when she gets a booking, the Traveler is charged 10 to 30% commission at the moment of booking.

the Owner+Traveler Oriented Model (or PayPerLead PPL): Neither the PO, nor the Traveler are charged all costs falling on the PM listing in bulk

The online vacation rental world has been quietly dominated by the PLW model ever since it's origin for well over a decade. It's not like the PAYG model did not exist, on the contrary, it was live and well since its origins when some locally based Property Management Companies (PMs) with a live website were using something similar to what is the PAYG model today. Most PMs were coming from the Real Estate Agents experience (if they weren't one themselves) and tended to charge both PO and Traveler. Come the mid 90's though, some PMs started charging only or mostly the traveler a commission which then also included fees on services such as cleaning/check-in etc (ie Roman Reference since 1997). Within the first decade of the new millennium a few pure websites using the PAYG model started pure online operations, one of these, of course, is Cities Reference since 2006. Enough of self quotations, just to hint that we know where we are coming from and what we're talking about here. Nevertheless, during the first decade of the new millennium online services were still broadly intended as owners' direct services with PLW models (today known under the oligopolistic brands of Homeaway (HA) and Tripadvisor/Flipkey (TA/FK) as opposed to local PMs using various forms of PAYG models which were less competitive in cost to travelers, but more competitive in service. The vacation rental market couldn't be called mature, but it had reached some sort of a balance.

Disruption came in 2008 when FK (now a Tripadvisor company) started a then totally new business model, the PayPerLead (PPL above), targeted straight to PMs that couldn't afford or wouldn't go for PLW listing. It was quite an innovation for the market and the first attempt to aggregate a very chaotic market offering a brand new channel for PMs where they could compete with their own brand.

At the turn of the second decade of the second millennium Airbnb (Air) got its venture's hundreds of millions (July 2011) and the PAYG model as a whole got a -very conservative since it's forgetting Wimdu and its peers altogether- cumulated 530$ millions up to 2013 and took the lead... that is, on the press and consequently on the general perception. Was that real disruption? Think again.

Number of properties: we all know how numbers can be delusional, if that is true in general, more so in vacation rentals. On our own experience the majority of properties have 1euro value per year against a top 10% of properties that are worth 500euro a year, still, this is a measure that must be taken into consideration. Airbnb declares 300,000 properties (other sources say 500,000, notably Ken Yeung in an article on thenextweb that doesn't reveal its sources), against Homeaway's 773,000 and Flipkey's 240,000.

Ever more interesting measure since we are calling Homeaway model Traveler Oriented! On the other hand these figures can't be taken without doubts, for example, the meta title of Homeaway.com reads '65,000 + vacation rentals worldwide.' Interesting... true they own tens of different websites and VRBO reads 'over 75,000 listings', but it's a safe guess that many properties overlap, that numbers declared will likely be floated etc. Anyway it is already something to know that Homeaway claims to have more properties than Airbnb and no-one, that I know of, has yet blowed the whistle. HA takes 1.

Number of destinations: 171 countries in Homeaway against 192 countries and 33,000 destinations in Airbnb and 11,000 destinations on FK. HA declines to share the number of destinations it covers, but we can play the same game of above and consider that Airbnb declares more destinations and no-one seems to be complaining about it, so far. 1 all.

Traffic: this is also an interesting exercise and we can use Alexa as a metric. Starting with the .com Air is ahead being 1,923 against 2,901 of HA (but it must be stressed that VRBO, a HA property, ranks 2,435, so better than its owner's company .com, still somewhat short of AIR, but that gives the general measure of how there cannot be competition among the two), FK is down at a mere 5,996, not so if you consider its mother company TA at 204 (!) although we don't think that could count here; co.uk HA is ahead being 12,129 against 17,866 (and it ownes Ownersdirect.co.uk wich is 16,537); .fr Air is 15,122 while HA with Abritel is 12,122 and with Homelidays is 13,012 so HA is ahead; .de Air is 18,609 HA with Fewo-Direct is 9,308, so HA ahead again; .it Air 18,165 and HA 41,698 so this time HA is big time in delay, AIR has a flair in Italy for some reasons; .es Air 16,809 against 53,364, so Air is leading again, but HA owns Toprural which ranks 24,114, so the spread is lower than you think.

Leaving aside FK which can't really compete here and looking deeper into the numbers we notice a number of interesting things: 1. that growth rate in traffic for HA is higher than for Air 2. that the search share of traffic is higher on HA(18.5%) then on Air (11.7%), does it spell for better SEO? 3. that traffic, although mainly US in both websites, is then distributed on travel buyer's countries (Spain, Italy, Canada, France - 16% of client base source Cities Reference) in HA as opposed to AIR that has secondary traffic distributed in more typically SEO labor countries (India, Mexico, Brazil, Thailand short of 2% of client base source Cities Reference) 4. On the other hand Air engages its users a lot more judging by bounce rate and pages per user, but this doesn't spell for higher conversions attending Compete.com. HA takes the lead again.

The Stock: If we give a look at what the financial guys are saying about this I'd like to take into consideration what Estimize says since starting last June they're publicly attempting to 'estimize' private companies. Here is what Estimize CEO/co-founder Mr. Drogen thinks about the matter we're discussing on this post. He runs an estimate on the base of what Airbnb states on its infographics and concludes that Airbnb is set to outrun HA. Is he right? I'd be very cautious about this, do read at the bottom of the above post how user AirBnB Whistleblower de-codifies numbers claimed on the infographic, de-codifying Airbnb numbers you'll find yourself listening to a different story from the one you're watching... HA 3, AIR 1. FK doesn't qualify here.

Mistifications: There seem to be little doubt on the mystifications of airbnb infographics as I was hinting above, this said on the contrary HA measures are relatively more reliable than Air's, there is more ahead on this. This is not because HA has better ethics, ethics has never been on HA menu, it's just because AIR has managed to still keep away from going public and avoid the scrutiny that follows IPOs. If you look carefully at the info-graphics below there is more than meets the eye. One example? "Guests nights booked" is not to be confused with actual nights booked, uh? HA 4, AIR 1.

Our Test: And... we have been testing the two behemoths this Fall! More precisely we posted 3 test properties: 1 in Rome, 1 in Paris and 1 villa in Sicily. The Paris apartment has 36% more visits on Airbnb than HA, but, mind you, no leads whatsoever, while TA has a 30% conversion into leads. FK here wins, it has way more traffic than both the above (~200%) with a 4% of conversion into leads and 3 real bookings made! The Rome apartment has 9% more visits on Airbnb, but, mind you, again no leads, while TA has an 18% conversion of lookers into leads, FK is a lot weaker than both here with about half traffic and 1% conversions and no bookings. The Sicily Villa has 18% more visits on AIR with ~1% of lookers converted into leads while HA has a 4% conversion. FK is extremely low on traffic with a ~1% conversion.

Pay attention, no bookings for the posted properties in the past 90 days neither from HA nor from AIR, but a bunch of leads from HA turned into other conversions in the rest of our inventory while nothing like that is possible in the closed system of Airbnb! FK converted only on the Paris apartment, but it has to be stressed that it wasn't new to the site and had reviews, while the new ones competing shoulder to shoulder didn't really qualify. Still it does work impressively when you get reviews. Look at this factor from the PMs perspective and... more on this ahead.

What do we see here? We see that numbers showed by Airbnb are, once again, dubious ~0% conversions on leads (mind you, it's Questions of travelers, not Bookings, what we're calling conversions here) on almost 1,000 visits compared to the over 20% conversions on the same properties on HA. Really? HA 5, AIR 1, FK1

How are they behaving? In everyday life it's the most common thing, to look at how a person is behaving and draw conclusions. If that still stand some chances of getting it right, does that rule still stand if there are big interests and organizations involved? Mmmm, not really. Looking at it from the outside we see HomeAway struggling. Every day there is a new, almost incomprehensible and very steep fee on their subscriptions page, now HA is even shooting on its own foot by opening to the PAYG model, see more details on Skift, while AirBnb is booming and busting on all medias and creating high expectations. We suspect this may all be a facade. HA seems to be struggling just because it's been a public company for years now and has to keep growing inventory and turn-over to make investors happy, while AirBnb shows hubris just because there are interest behind them ever since they got their venture money that want to turn them into the next internet bubble IPO and will possibly abandon it soon after. There is ground here to doubt that AIR will keep shining for long after going public. FK has been also embracing revenue share. So, this is still a score to AIR though: 5 to 2.

Our Poll or the users' perception: We've been running a poll with our users, travelers, POs and PMs. General perception of travelers is all for AIR, they vote for their graphics (which has been defined as shiny and cool as opposed to boring and depressing for HA), for their social appeal and easiness of use. Most also post their own apartments. But they list as travelers, not professionals, they don't update the calendars, reply only if the request falls in the right dates, or if the user looks cool, they (ouch!) wouldn't even consider listing with Cities Reference when asked (not to our face!), never mind HA that is even asking for money. POs and PMs are divided, we've been surprised finding out that almost 30% of PMs also uses AIR and declares itself satisfied by it. That's definitely a go for AIR again 5 to 3.

We have a winner of our little game: HomeAway! Flipkey comes a good second, AIR from our perspective looks in quagmires.

Really, why do we think that, against all odds, taking the press online and offline (see estimize above), against the general perception, see our poll, against what we thought ourselves just until a couple of years ago, the HomeAway model will win the battle over the vacation rental world dominance? Let's look at it from the perspective of those that actually use these tools, once the shine about the 'new' tool (is it really new? I will soon post a 'Disruptive Innovation or... just Disruptive' article about the elephant in the room of vacation rental) will fade away, they will have to cope with facts, and here is how we see the facts from the different perspectives.

The Traveler perspective: young travelers are charmed by the social feel, the easiness of use, the bright colors of AIR/PAYG websites and claim not to even consider PLW websites. Seasoned travelers on the contrary are matter of fact and realize that PLW and PPL websites won't charge commissions and eventually will give them better deals. Phocuswright claims that vacation rentals are mainly used by families and groups that are more price sensitive, the average 15% overcharge of PAYG websites, once the hipe is over, will make a difference.

The Property Owner perspective: It is true that property owners don't like to pay in advance and in the case of Homeaway prices are getting steeper and ever more complicated by the day, which doesn't help. Still, as we've seen on our testing, PAYG websites will hardly give you a full occupancy unless the apartment you're listing is sold at a net price below its market value. It is important to stress that all the property owners we have interviewed once they pay the flat annual fee to PLW websites just forget about that charge and when they list on PAYG websites they will not write it off the base price creating an extra charge that will be pushed on to the traveler buying on PAYG websites. Get a better grasp on how this maybe a problem for PAYG websites on our previous post 'The ponderability of Prices'

The Property Manager perspective: Most PM marketing departments are understaffed. PMs are historically more focused on operational and sales (meaning acquisitions of new properties). Closed systems on PAYGs websites like Airbnb force them to list each single property thereby using a lot of their precious time for precious little conversions. Until Homeaway will close a blind eye on PMs listings multiple properties at a discount as private owners (that are ranked better on most PLW websites), the possibility of moving leads across their inventory will push more and more PMs towards PLWs as opposed to PAYGs which use closed systems that are at odds with the way most PMs conduct their businesses. Finally, PPL is a fantastic deal for PMs that can afford the little technology required to pass the properties to PPL websites in mass.

I would like to close this with a note on what my really be THE disruptive innovation taking more and more shape now in the vacation rental market. Channel managers, like Rentals United and Kigo, they are a further tool in the hands of PMs to pool together and share properties and bookings. We'll dedicate a post to it soon, but this may really be the future of the market. Keep posted ;)